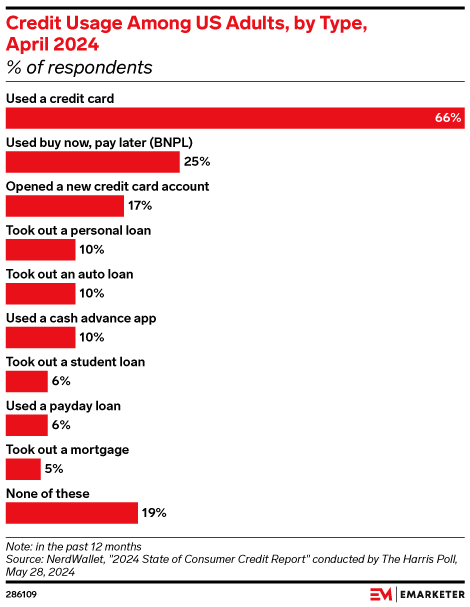

Two-thirds (66%) of US individuals have used a credit card in the last year, making it the most prevalent way of credit usage, according to an April 2024 study by NerdWallet conducted by The Harris Poll.

“Continued concern for the economy may cause consumers to rely more heavily on credit cards and buy now, pay later (BNPL) services in the future,” reported EMarketer.

According to NerdWallet, 16% of customers who have used a credit card in the last year used it for needs because they did not have enough money to pay for these costs in full.

According to a TransUnion survey, 84% of consumers rank inflation as one of their top three financial concerns, a five-point increase year on year and the highest level in two years.

Ariel Ben Solomon is the Growth and Strategy manager at Ecomhunt. He is the host of the Ecomhunt Podcast. Can be followed on Twitter at @ArielBenSolomon