Dropshipping has emerged as a popular e-commerce model, allowing entrepreneurs to start online businesses without managing inventory or handling shipping. The success of a dropshipping venture hinges significantly on the quality and reliability of its suppliers. Establishing strong, mutually beneficial relationships with dropshipping suppliers is crucial for ensuring smooth operations, customer satisfaction, and ultimately, profitability. This article will delve into the intricacies of working with dropshipping suppliers, providing a comprehensive guide to navigating the supplier landscape and building a thriving dropshipping business. From finding the right partners to managing orders and resolving conflicts, we’ll cover essential strategies for optimizing your supplier relationships and achieving long-term success.

Understanding Dropshipping Supplier Relationships

Dropshipping supplier relationships are fundamentally partnerships built on trust and mutual benefit. Unlike traditional retail models where you purchase and hold inventory, in dropshipping, the supplier handles the inventory, packaging, and shipping directly to your customer. This makes the supplier a critical extension of your business.

Understanding the dynamics of this relationship is paramount. You are relying on the supplier to accurately fulfill orders, maintain product quality, and provide timely shipping. Any failures on their part directly impact your brand reputation and customer satisfaction.

The relationship goes beyond simply placing orders. It involves clear communication, agreed-upon terms, and a shared understanding of expectations. This includes order processing times, shipping methods, inventory levels, and return policies.

A successful dropshipping business requires a proactive approach to supplier management. Regularly communicating with your suppliers, monitoring their performance, and addressing any issues promptly are essential.

Building a strong relationship with your suppliers can lead to several advantages, including preferential pricing, priority order processing, and access to new product lines.

It’s important to view your suppliers as partners, not just vendors. Investing time and effort in nurturing these relationships can pay dividends in the long run.

Think of your supplier as an invisible member of your team. Their success is directly tied to your success, and vice versa.

A transparent and collaborative relationship fosters trust and encourages suppliers to go the extra mile for your business.

Consider implementing a system for tracking supplier performance, such as key performance indicators (KPIs) related to order fulfillment, shipping times, and product quality.

Ultimately, understanding the nuances of dropshipping supplier relationships is the foundation for building a sustainable and profitable business.

Finding the Right Dropshipping Suppliers for Your Needs

Finding the right dropshipping suppliers is a critical step in establishing a successful online business. It requires careful research and evaluation to ensure you partner with reliable and reputable suppliers.

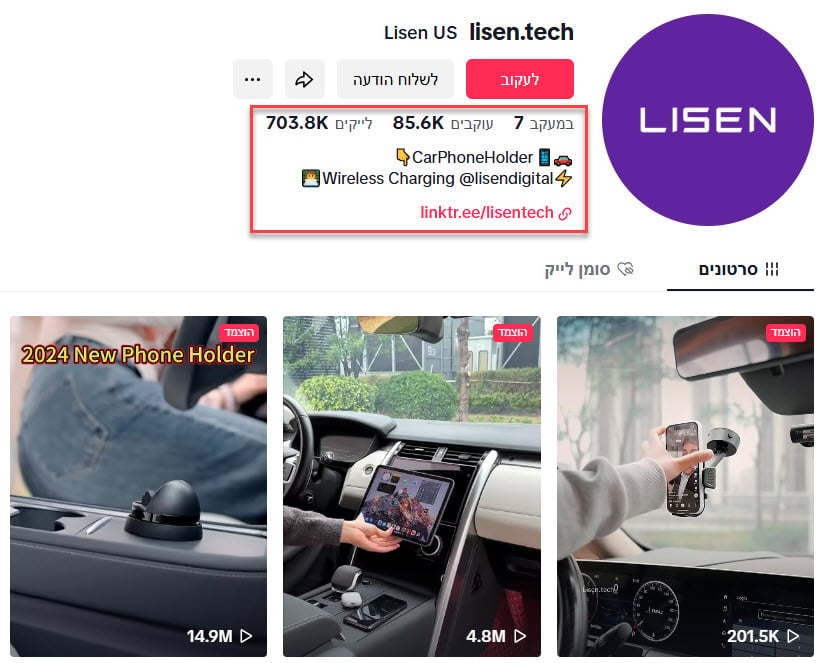

Start by identifying your niche and the specific products you want to sell. This will help you narrow down your search for suppliers who specialize in those products.

Explore various online directories and marketplaces that list dropshipping suppliers. Examples include SaleHoo, Worldwide Brands, and AliExpress.

Attend industry trade shows and events to network with potential suppliers and learn about new products and trends.

Look for suppliers who offer a wide range of products, competitive pricing, and fast shipping times. These factors are crucial for attracting and retaining customers.

Consider suppliers who offer private labeling or custom packaging options, which can help you build your brand identity.

Check supplier reviews and ratings on independent websites and forums to get an idea of their reputation and reliability.

Contact potential suppliers directly to inquire about their terms of service, shipping policies, and return procedures.

Request samples of their products to assess the quality and ensure they meet your standards.

Compare the pricing, shipping costs, and other fees of different suppliers to find the best deal.

Don’t be afraid to negotiate with suppliers to get better pricing or terms. Building a strong relationship with your suppliers can often lead to more favorable deals.

Vetting Potential Dropshipping Suppliers: Key Checks

Vetting potential dropshipping suppliers is a crucial step in ensuring the success of your business. Thorough due diligence can help you avoid unreliable suppliers and protect your brand reputation.

Verify the supplier’s business credentials, including their registration, licenses, and certifications. This helps ensure they are a legitimate and reputable company.

Check their website for professionalism, clear contact information, and detailed product descriptions. A well-maintained website is a sign of a serious and trustworthy supplier.

Read online reviews and testimonials from other customers to get an idea of their experience with the supplier. Pay attention to both positive and negative feedback.

Contact the supplier directly to ask questions about their products, shipping policies, and return procedures. Assess their responsiveness and professionalism.

Request samples of their products to evaluate the quality and ensure they meet your standards. This is especially important if you are selling high-end or specialized products.

Inquire about their inventory management system and order fulfillment process. Ensure they have the capacity to handle your order volume and ship products quickly and efficiently.

Ask about their quality control measures and how they handle defective or damaged products. A reliable supplier should have a clear process for resolving such issues.

Check their payment terms and security measures. Ensure they offer secure payment options and protect your financial information.

Verify their shipping times and methods. Look for suppliers who offer fast and reliable shipping to your target markets.

Consider conducting a background check on the supplier to identify any potential red flags, such as legal issues or financial problems.

When verifying shipping times and methods, it’s essential to choose suppliers who can guarantee fast and reliable delivery to your target markets. For instance, Rush Order provides efficient shipping tools that streamline the entire process, making it easier for businesses to manage delivery timelines. Fast shipping not only enhances customer satisfaction but also strengthens your reputation as a reliable seller. By selecting a supplier that offers robust shipping solutions, you can ensure a smoother customer experience and build long-term trust with your audience.

Establishing Clear Communication with Suppliers

Clear and consistent communication is the cornerstone of a successful dropshipping business. It ensures that both you and your suppliers are on the same page, minimizing errors and maximizing efficiency.

Establish a dedicated communication channel with your suppliers, such as email, phone, or a messaging platform. This will make it easier to stay in touch and resolve issues quickly.

Clearly define your expectations regarding order processing times, shipping methods, and product quality. Document these expectations in a written agreement or service level agreement (SLA).

Provide your suppliers with accurate and detailed order information, including product specifications, shipping addresses, and customer contact information.

Respond promptly to supplier inquiries and requests. This demonstrates your commitment to the partnership and helps build trust.

Regularly communicate with your suppliers to discuss any issues or concerns. Address problems proactively to prevent them from escalating.

Provide feedback to your suppliers on their performance, both positive and negative. This helps them improve their services and meet your expectations.

Use clear and concise language in your communication. Avoid jargon or technical terms that your suppliers may not understand.

Document all communication with your suppliers, including emails, phone calls, and meeting notes. This will provide a record of your interactions and help resolve any disputes.

Consider using project management tools or collaboration platforms to streamline communication and track progress on orders and projects.

Establish a regular schedule for communication with your suppliers, such as weekly or monthly check-in calls. This will help maintain a strong relationship and stay informed about any changes or updates.

Managing Dropshipping Orders and Inventory Effectively

Efficient order and inventory management is crucial for a smooth and profitable dropshipping operation. It ensures that orders are processed accurately and delivered on time, while minimizing stockouts and delays.

Implement an order management system that integrates with your e-commerce platform and your suppliers’ systems. This will automate the order processing workflow and reduce manual errors.

Regularly monitor your inventory levels to identify potential stockouts or overstocks. Use data analytics to forecast demand and adjust your inventory accordingly.

Communicate frequently with your suppliers about inventory levels and lead times. This will help you avoid stockouts and ensure that products are available when customers order them.

Implement a system for tracking orders from placement to delivery. This will allow you to monitor the progress of each order and identify any potential issues.

Provide your customers with accurate tracking information so they can monitor the progress of their orders. This will improve customer satisfaction and reduce inquiries.

Establish a clear process for handling order cancellations and modifications. Communicate this process to your customers and your suppliers.

Regularly review your order fulfillment process to identify areas for improvement. Look for ways to streamline the process and reduce costs.

Consider using a third-party logistics (3PL) provider to manage your inventory and fulfillment. This can free up your time to focus on other aspects of your business.

Implement a system for managing backorders. Communicate with your customers about the expected delivery time and provide them with options, such as a refund or a replacement.

Regularly audit your inventory and order management system to ensure accuracy and efficiency. This will help you identify and correct any errors or inefficiencies.

Handling Returns and Refunds with Your Dropshipper

Returns and refunds are an inevitable part of any e-commerce business, and it’s crucial to have a clear and efficient process for handling them with your dropshipping supplier. A well-managed return and refund process can minimize losses and maintain customer satisfaction.

Establish a clear return and refund policy that is communicated to both your customers and your suppliers. This policy should outline the conditions under which returns and refunds are accepted, as well as the process for initiating a return.

Clearly define who is responsible for paying for return shipping costs. This is a critical aspect of your return policy and should be clearly stated.

Communicate with your supplier about any returns or refunds promptly. Provide them with all the necessary information, such as the order number, the reason for the return, and the customer’s contact information.

Establish a process for inspecting returned products. Determine whether the product is defective or damaged, or if the return is due to customer error.

Negotiate with your supplier about the cost of returns and refunds. Try to reach an agreement that is fair to both parties.

Consider offering store credit or exchanges as an alternative to refunds. This can help retain customers and reduce losses.

Use a returns management system to track returns and refunds. This will help you monitor the process and identify any potential issues.

Regularly review your return and refund policy to ensure it is fair and effective. Make adjustments as needed based on customer feedback and business needs.

Train your customer service team on how to handle returns and refunds. Ensure they are knowledgeable about your return policy.

To Sum It Up

Dropshipping suppliers is a huge upgrade over using Aliexpress classic Dropshipping. From much faster shipping times to having someone to talk to if something goes wrong, this is the way to advance in the Dropshipping world and scale up your online business.

But one must be careful when choosing a supplier so make sure to follow the tips in this article to choose the right supplier for your business.

Good luck!