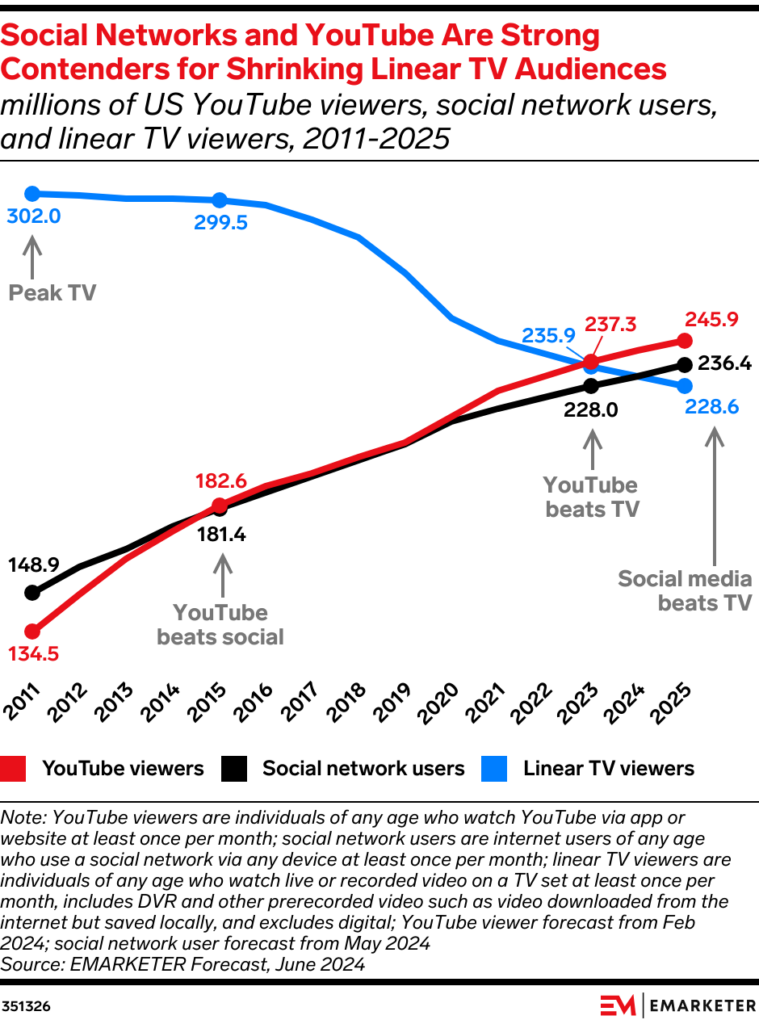

In 2025, social media users in the US will outnumber linear TV viewers for the first time, according to EMarketer’s June 2024 forecast.

According to the data, 236.4 million Americans will be active on social networks, compared to 228.6 million who will still watch linear TV.

Despite this shift, linear TV will continue to command more video viewing time. US adults are expected to spend nearly three hours daily on it, compared to 53 minutes on social media and 37 minutes on YouTube.

For digital advertisers, this trend highlights the opportunity to reallocate ad spend from traditional TV to social platforms, tracking viewers’ migration and capturing their attention where it’s increasingly focused.